Compared to the beginning of July the interest rates for newly issued EUR loans on Mintos are much lower now. While investors enjoyed interest rates of up to 13-14% for loans issued in the first half of the year, typical rates are 8-11% now, with a 12-13% for more exotic loans mixed in.

Cause of the change in market condition was that Mogo, one of the larger loan originators on Mintos, issued a bond worth EUR 50 million, with an annual interest rate of 9.5% (ISIN XS1831877755) on June 25, 2018 and Mogo announced that starting from July 13, 2018, Mogo would partially repurchase loans from investors on Mintos using their call option as stipulated in the assignment agreement. During July, Mogo plans to gradually repurchase in total up to EUR 16 million net of loans issued to borrowers in Bulgaria, Estonia, Latvia, Lithuania, Poland, and Romania.

Following the repurchase, the interest rates for newly issued EUR loans were sharply lower not only for Mogo loans but also for loans of the other originators on the Mintos platform.

This left most investors with a lot of cash in their accounts, as commonly 1/3 to 2/3 of all the Mogo loans in their portfolios had been repurchased and their previously configured autoinvests did not match any loans any more at their set interest rates.

To find out how investors reacted to the situation P2P-Kredite.com conducted a survey among German speaking Mintos investors. Here are the preliminary results (48 respondents):

- 35% say they withdraw uninvested cash and invest it on other p2p lending platforms

- 21% say they continue to invest on Mintos primary market

- 17% say they just wait, the interest rates will rise again

- 15% say they withdraw uninvested cash and invest it in other asset classes (e.g stock)

- 12% say they buy on the Mintos secondary market now, instead of using the primary market

For continental European investors looking for high yield alternatives here are 5 platforms that survey respondents liked:

- Bondora

Bondora is a long established Estonian company offering consumer loans in Estonia, Finland and Spain. Investors can choose between their new “Go&Grow” product (up to 6.75% interest) or the self-select autoinvest options with individual loans yielding much higher (nominal) interest rates - Estateguru

Estateguru is a marketplace for property secured loans mostly in the baltic countries. Typical interest rates are 10-12%. Investors pick individual loans or enable autoinvest - Grupeer

Grupeer is a young Latvian platform gaining popularity among the German investors. They list business and development loans in several countries (e.g. Latvia, Russia, Belarus, Norway, Poland). Typical interest rates are 14-15% - Peerberry

Peerberry is a young Latvian platform listing consumer and property loans in several countries (e.g. Lithuania, Poland, Czech Republic, Ukraine). Typical interest rates are 11-13% - Robocash

Robocash is a Latvian platform listing consumer loans in Kazachstan and Spain. Typical interest rates are 14-14.5%.

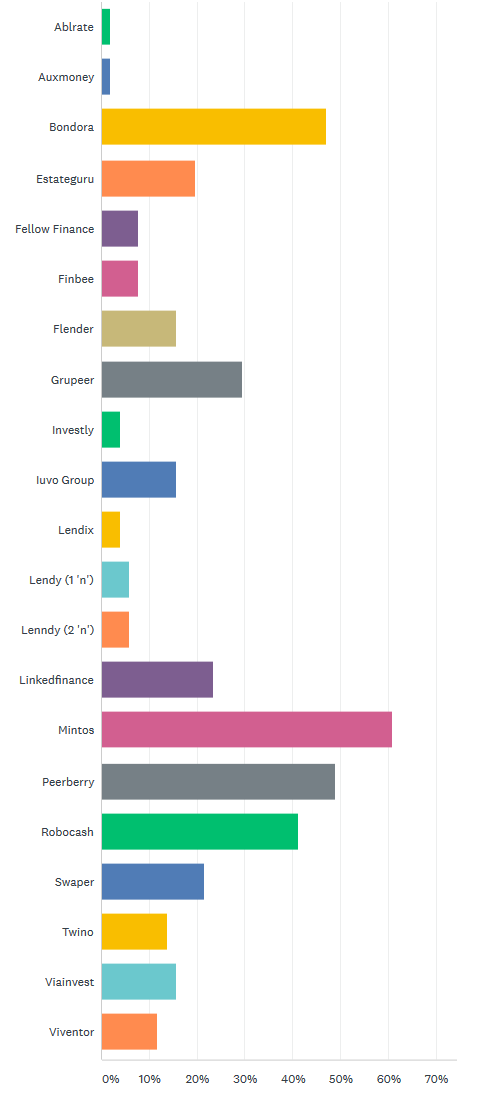

This selection is based on the likings of German speaking investors that voted in August for best p2p lending platform in a P2P-Kredite.com survey:

51 respondents, platforms that got no votes are not shown

The survey shows that Mintos is still rated number one in investor opinion among the queried audience, but the others are catching up (compared to similar surveys in the past).

My own Mintos portfolio shrank to less than 40% of its previous size as only less than 1/3 of the Mogo loans I had in early July are still in my portfolio. I withdrew a lot of cash and have transfered it to other p2p lending market places. Of course I’ll hold on to the my remaining Mogo loans as nearly all of them are at 13-14% interest rate.

Unfortunately the secondary market is also no longer an option as discounts on loans were drastically reduced in the last few days.

Yeah, availibity of higher YTM parts there was fueled until last Sunday by investors that obtained new loans cashing the 1% autoinvest cashback and then immediately selling these loans at -0.5% or -0.4% discount on the secondary market. Now that this cashback campaign has ended investors bought up all higher YTM offers on the secondary market so it does not offer higher yields than the primary market any more

I’m amazed that so many people like Bondora. I guess most of them have invested for less than 1 year and have no idea how bad it’s going to be.

Exactly, they will soon learn that their actual returns are 4%-6% a year at best. Plus the hope that the returns will increase retroactively as collections for loans defaulted in past years get going.

Yeah I’m also amazed. You had the same experience as me with Bondora.

I think Mintos is still one of the best P2P website. And that´´´ s because the buy back guarantee.

Buyback guarantee is just nice marketing tool…Look how it was with Buyback and Eurocent!!!

You need to do your share of due diligence and pay attention to the annual reports of loan originators. For those of them who are in a healthy state and have positive equity, the buyback guarantee means a lot.

Unbelievably how high PeerBerry scores when they are so new. However, 51 respondents are not many.

I also experience lower interest rates on Mintos.