When I started in late 2014 the UK p2p lending marketplace Lendy was still called Saving Stream, but it rebranded this year. Lendy is a platform offering bridge loans secured by property. I last reviewed my portfolio performance here on the blog in January 2016. Since then the following major changes have taken place at Lendy:

- Different interest rates

Initially all loans had carried 12% interest. Now Lendy assigns different interest rates to each loan. Interest range for investors on new loans now are in the range between 7 and 12%. - Lendy sold the security of the second defaulted loan (Garden Center). While all lenders got principal and interest paid on this loan, the sale price of the security was below the loan amount. Lendy covered the shortfall from own funds (provision fund).

- Since March 2017 investor can not buy loans on the secondary market and deposit funds afterwards (this still is possible on the primary market). This has reduced liquidity of the secondary market somewhat, but in general it is still pretty liquid for those loans that have a middle to long remaining term.

- Since April 2017 there is a new default policy in effect. For loans more than 90 days overdue interest continues to accrue but will not be paid until Lendy has received payment by the borrower. All loans more than 180 days overdue are now automatically classified as default loans. The number of defaulted loans has risen to 14 at the time of this writing.

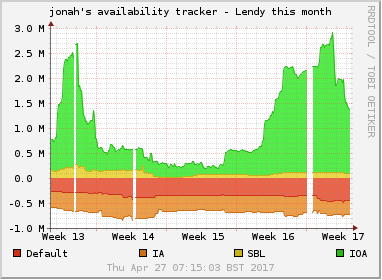

Especially the last point has triggered debates on the chances for recovery and there are concerns voiced among investors about to optimistic valuations. The secondary market swings from time to time between mosty empty (except for loans in default) and plenty.

Especially the last point has triggered debates on the chances for recovery and there are concerns voiced among investors about to optimistic valuations. The secondary market swings from time to time between mosty empty (except for loans in default) and plenty.

My portfolio

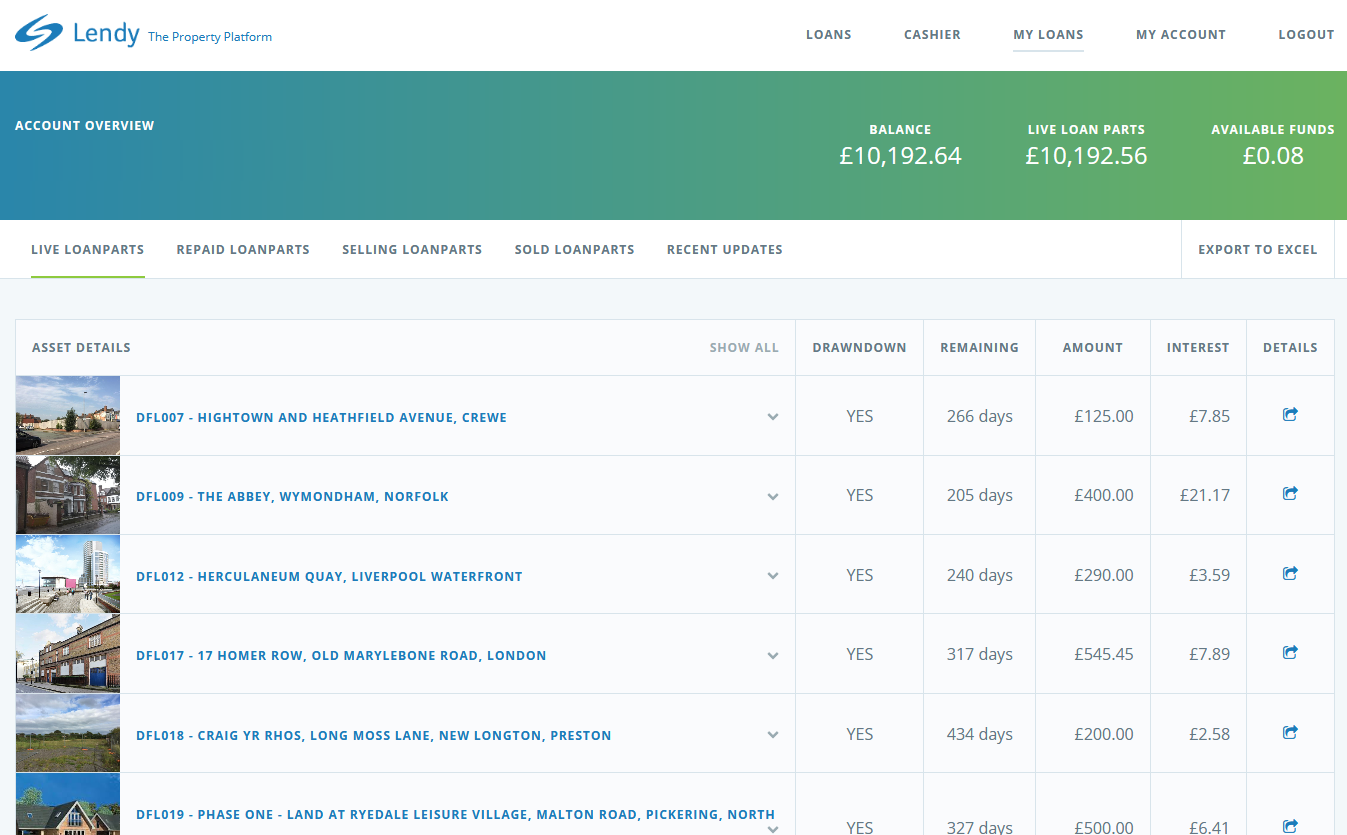

I have continued to ramp up my portfolio reinvesting returns and making new deposits via Transferwise and Currencyfair. This was before the Brexit decision. As for now I am simply reinvesting. My portfolio amount is 10K GBP spread out over 14 different loans. The vast majority is in 12% interest rate loans. I have made three exceptions in the past, but usually only with low amounts and when rebalancing the portfolio, I try to sell these lower interest loans first. So far I have not had any loans in overdue or default state – but there are many of those on the platform (see above). My loans have long remaining terms with the shortest being 147 days at the moment.

My yield (self calculated with XIRR) so far is 12.1% in GBP. Unfortunately I deposited most funds during the time when the pound was at a high, therefore calculated in Euro currency the yield is only 4.4% for me.

Lendy is still one of my preferred p2p lending marketplaces, due to interest rates, real estate as a security and liquidity. I do see the risks in the valuations, but I figure that at least the security will cover part of the loan amount and will with a high probability prevent total loss in a defaulted loan. I might get more picky in selecting loans, but so far Lendy for me is actually a platform that requires less management and monitoring than several other marketplaces I use.

Screenshot of top of my loan portfolio list at Lendy – click for larger view

I have to say I’m very surprised that your average risk per loan is more than 7% of your portfolio value. I strive to have between 1-2% risk per loan and if they had a true hands-off auto-invest feature I would go to half that.

I am not as diversified on Lendy as on other p2p lending marketplace as the loans are secured (therefore total loss in case of default of a loan is very unlikely though not impossible) and I do not hold my loan parts to maturity

Really nice analysis thanks, I have over £300K in Lendy split over a number of accounts, and the increasing lack of liquidity is becoming a problem. It is no longer always possible to “flip” my loans to ones that have longer to run to maturity.

Loans in default are a problem for Lendy because there is nearly £14m tied up in defaulted loans (May 26th 2017), I guess that these funds would normally have been re-invested, but there it languishes. It is unfortunate that the investor has to “pay” for Lendy’s inability to sell the defaulted assets quickly enough (perhaps a result of over enthusiastic valuations). But if there are losses of 2, 3, 5% on these defaulted loans then that is what we must expect for our return.

By the way I nearly always invest in loans with the full 12% interest, imho there is simply not enough information given to the investors to be able to weigh up the risks of individual loans and valuations, we are left to take Lendy’s word for it.

By the way, last point that some investors might not realise is that when they put a loan part up for sale it earns no interest for that period