Last year I started investing on British p2p lending marketplace Moneything. Read my past article about opening a Moneything account. Moneything mostly offers property backed loans, with a few different asset-backed deals in between. I used Transferwise and Currencyfair to deposit money from my Euro account. Recently I also used the Revolut App to transfer money from another UK p2p lending marketplace to Moneything.

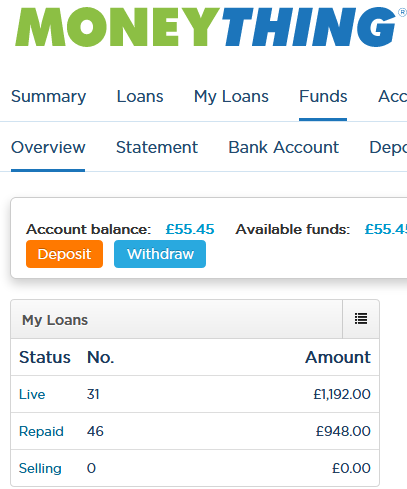

Looking back over the past year my experience with investing on Moneything has been very good. I am invested in 31 loans right now, mostly at 12% interest rate with small amounts also at 10.5%, 11% and 13% invested. I have had no defaults and there are no fees for investors. The website functions well and support is reported to be very responsive (I actually did not need it yet). The secondary market is extremly liquid, loan parts often sell within second. The only two minor downsides of the Moneything platforms for me are that investor demand by far outstrip loan offers. And there is no autoinvest, so usually it is necessary to login shortly after 4pm UK to invest into new loans. My yield (self calculated with XIRR) so far is 12.0% in GBP. However due to currency fluctuation in EUR it is only 7.2% at the moment.

Looking back over the past year my experience with investing on Moneything has been very good. I am invested in 31 loans right now, mostly at 12% interest rate with small amounts also at 10.5%, 11% and 13% invested. I have had no defaults and there are no fees for investors. The website functions well and support is reported to be very responsive (I actually did not need it yet). The secondary market is extremly liquid, loan parts often sell within second. The only two minor downsides of the Moneything platforms for me are that investor demand by far outstrip loan offers. And there is no autoinvest, so usually it is necessary to login shortly after 4pm UK to invest into new loans. My yield (self calculated with XIRR) so far is 12.0% in GBP. However due to currency fluctuation in EUR it is only 7.2% at the moment.

So if all is great, why did I not invest more? Well, I planned to, but shortly after I started, Brexit vote took me by surprise and I abandonned my plans to ramp up my investment amount, due to the higher currency volatility uncertainty. Instead I am now mainly reinvesting funds and in addition add funds already in GBP, which I move over from other UK platforms via Revolut.

Earlier this month Moneything gained full FCA approval. This is the prerequisite for launching an IFISA product, which allows tax-free investing for UK investors (compare IFISA providers in our database). Surprisingly Moneything just said, they are in no hurry to launch an IFISA offer but rather wants to built loan originations first. This makes sense because the increased deposit influx by an IFISA offer would imbalance demand and supply even further.

I share your views regarding the positive points of MoneyThing. I do however feel very unconfortable with the small amount of loans coming thorugh the platform. For me, this has resulted in my loans having to be very concentrated in Asset Exchange’s grouped asset loans with an LTV of 80% and stocking loans with an LTV of 70%. So far no loan has gone unredeemed, unlike in FundingSecure which has seen a lot of that lately, but if Asset Exchange experiences problems watch out…

I currently invest in three platforms in the UK (Moneything, FundingSecure, Lendy) and none has an auto-invest feature. Lendix in France and Klear in Bulgaria also have no auto-invest. On the other hand in the Baltic countries it seems that all P2P platforms sport some kind of auto-invest feature. It makes achieving diversification a much easier task, why is it that the UK which is such a big P2P market does not have it? Do you know?

Hi José, I can only guess that it has not been a priority for those marketplaces. Potentially investors are more selective on property loans and therefore autoinvest is not as much in demand as on consumer loan platforms. E.g. for a long time Estateguru did not have autoinvest either But actually there has been some discussion from Moneything that they may offer autoinvest in the future.