Since my p2p lending investments are heavily concentrated on UK and Baltic services, one of my New Year’s resolution for 2017 was to diversify into other markets. Therefore in January I opened an account at French p2p lending service Lendix. Lendix is a p2p lending marketplace offering loans to SMEs in France and Spain (read earlier articles on Lendix). It is one of the larger players in continental Europe. Signing up was straightforward. While the minimum bid on loans is just 20 EUR, the minimum amount for deposits and withdrawals is 100 EUR. Investors can deposit either via bank transfer or via credit card (limited amount). Depositing via credit card is a nice feature which is rarely offered by p2p lending services. I like it because I can react within a minute to new loan announcement emails. This is necessary too, as many new loans are fully funded within an hour – and there is no autoinvest. Nearly all actions require two factor authorisation by a code sent to my mobile.

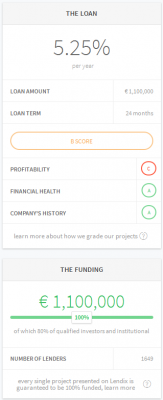

Lendix loans carry interest rates from 4 to 9.9% and are for loan terms between 3 and 84 months. There is no fee for investors and no withholding tax for foreign residents. Each loan is assigned a rating score of A, B or C by Lendix. There is also a detailed loan description for each loan. While most of the site is available in English language, loan descriptions and contracts are in French language only.

Lendix loans carry interest rates from 4 to 9.9% and are for loan terms between 3 and 84 months. There is no fee for investors and no withholding tax for foreign residents. Each loan is assigned a rating score of A, B or C by Lendix. There is also a detailed loan description for each loan. While most of the site is available in English language, loan descriptions and contracts are in French language only.

So far Lendix has done a very good job in vetting borrower applications. The default rate to date is low – only 0.11%. However the marketplace is young and growing and I expect the default rate to rise with time. Also it remains to be seen, if the perfomance of the Spanish loan will be comparable to the French loans.

As there is no secondary market, investors are bound hold the loan to maturity.

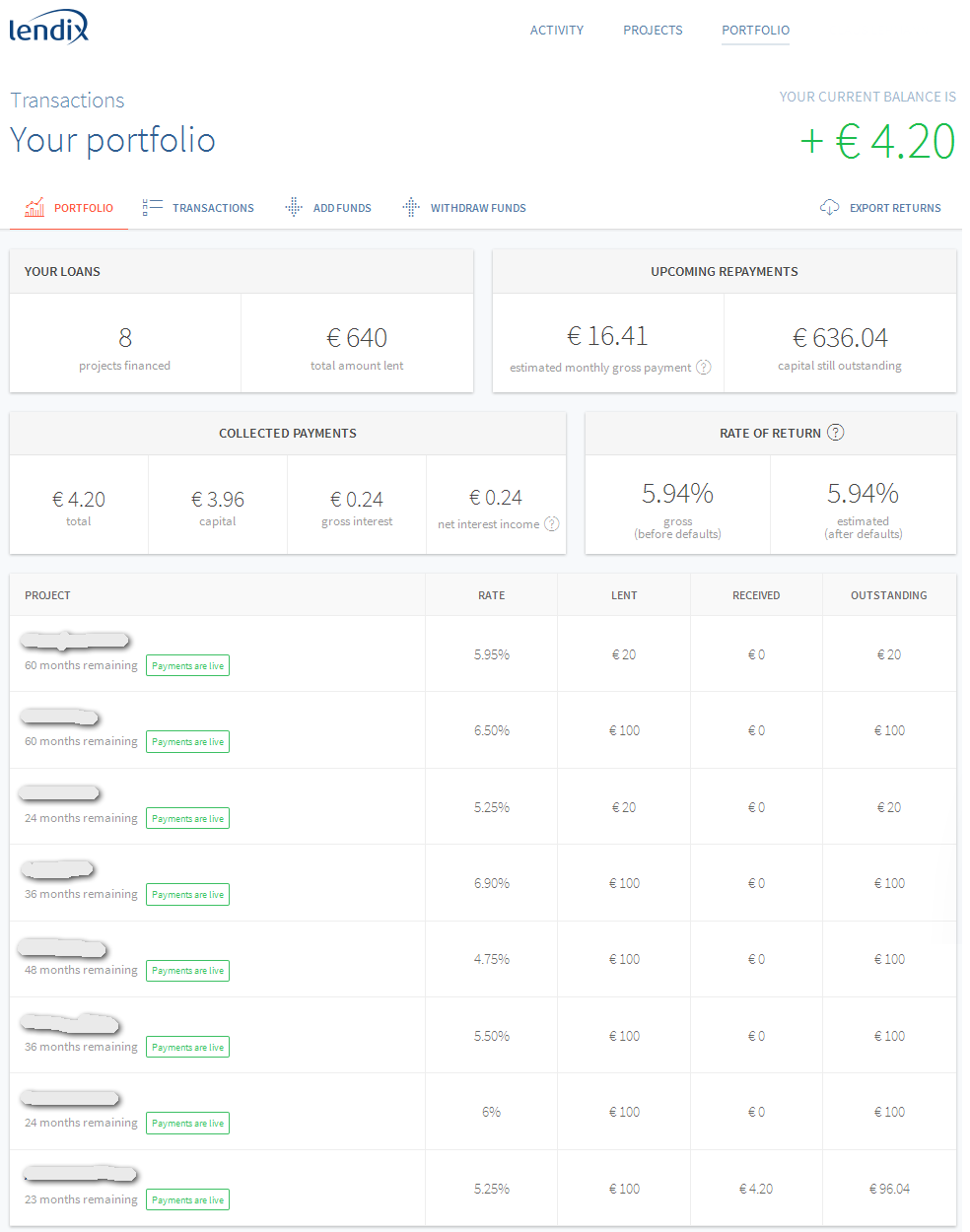

Review of my Lendix portfolio

I only just started in January. I concentrated on A and B grade loans, putting 100 EUR in most of them and 20 EUR in those that seemed not as convincing to me (e.g. a loan to a hotel that, when I looked it up on a hotel booking comparision site, had less satisfied customer reviews than the four other competing hotels in the same village). I skipped the new spanish loans.

Right now I have invested 640 EUR in 8 Lendix loans. I would have invested more, but I found the dealflow to be rather sparse in January and February. My average interest rate is 5.9%. This month I received my first repayment rate. Experiences of more seasoned investors report that repayments are usually on-time.

New investors get 20 EUR cashback bonus from Lendix when signing up via this link, once they have invested at least 500 EUR.

Screenshot of my Lendix loan portfolio – click for larger view