This is a guest post by Pawee Jenweeranon, a graduate school student of the program for leading graduate schools – cross border legal institution design, Nagoya University, Japan. Pawee is a former legal officer of the Supreme Court of Thailand. His research interests include internet finance and patent law in the IT industry.

1. Introduction : The Peer-to-peer Lending Industry in Thailand

Peer-to-peer lending which also known as social lending or crowd lending has drastically increased in the recent years in many countries over the world. The volume of peer-to-peer lending activities also has been grown rapidly, for instance, the volume of peer-to-peer lending activities in U.K. has doubled every year in the last four years.

Peer-to-peer lending might be used in many ways if it is properly regulated by the responsible authorities, this is one of the reasons which lead to the issuance of the consultation paper to regulate peer-to-peer lending industry by the Bank of Thailand.

For instance, due to the current situation, poor people and SMEs in Thailand normally face difficulties in accessing finance from banks or traditional financial institutions[i]. This affects the increasing number of informal loans outside the financial institution system which are normally illegal, specifically; the problem of informal loans currently stood at more than 5 trillion baht and covered around 8 million households in Thailand[ii].

SMEs are very important in the context of economic development for Thailand due to the statistics provided by the Thai Securities and Exchange Commission (hereinafter referred to as “SECâ€), SMEs are the most significant source of employment and job growth in Thailand[iii]. SMEs in Thailand also accounted for 37.1 percent of GDP. Additionally, on the export side, SMEs accounted for 28.4 percent of a total amount of export of Thailand[iv]. The most difficulty for Thai SMEs is that they have had difficulty in borrowing money from the banks or financial institutions. In other words, the cost for getting bank loans in Thailand is rather high[v].

The difficulty in access to finance of Thai local people and SMEs is one of the main reason led to the proposing of regulatory framework for alternative finance especially in internet finance development in Thailand which will be discuss herein.

Peer-to-peer lending might be used to increase the access to finance rate of SMEs to develop Thai economic indirectly by this channel.

To prevent any possible risks is another reason which is considered by Bank of Thailand. Specifically, Bank of Thailand expressed concern that the peer-to-peer lending industry might affect the monetary stability of Thailand in the near future.

2. The Legislative Effort to regulate P2P Lending Industry

Bank of Thailand issues the consultation paper regarding a regulatory framework to regulate peer-to-peer lending via electronic method[vi]. The consultation has been issued at 30 September 2016 in the purpose of exploring an appropriate regulatory framework for scoping a peer-to-peer lending industry.

In brief, this consultation paper includes the duties which peer-to-peer lending platform such as a disclosure duty of a peer-to-peer lending platform, the regulation related to an agreement between a lender and borrower, a qualification for being peer-to-peer lending operator for a non-financial institution. Also, a qualification of a lender/investor and a borrower was included in the consultation paper in section 2 etc.

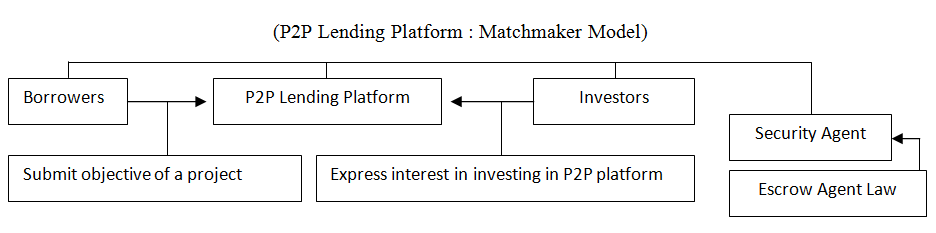

However, due to the reason that peer-to-peer lending can be separated into main three types which are matchmaker, credit lender and notary model. It should be noted that this consultation paper only focuses on the first type of peer-to-peer lending which is matchmaker type. Also, case of debt crowdfunding, equity crowdfunding and outsourcer has not been governed by the proposed regulations in the consultation paper.

In specific, the matchmaker can be clarified as the following diagram;

The consultation paper includes various issues such as;

(1) Guideline related to IT infrastructure of P2P lending platform to prevent cyber risks.

(2) Disclosure duties of P2P lending platform, specifically, a P2P lending platform shall disclose any related information of a service provider, loan and any complaint.

(3) The requirements for being a P2P lending platform.

(4) The qualification of an investor and borrower.

(5) The restriction about the advertisement of platform.

(6) The regulation for a non-financial institution operator.

This article explores the significant issues which might be interested as follows;

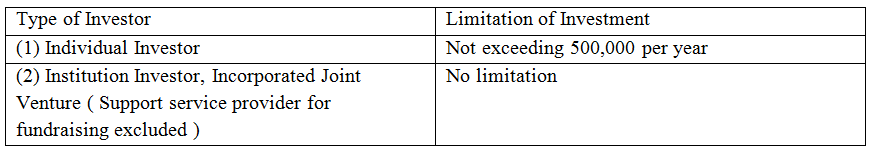

(a) For anyone who is interested to invest money in P2P lending platform, there is limitation in an amount of investment which has been proposed as provided in the following table;

(b) For anyone who wish to operate P2P lending platform in Thailand, there are duties and requirements which need to be considered such as;

(2.1) The duty to prepare IT infrastructure to prevent any cyber risks such as a track record for submitting to the Bank of Thailand.

(2.2) The duty to prepare the Business Continuity Management (BCM).

(2.3) The duty to handle a customer complaint regarding P2P operation.

(2.4) The duty to follow any instruction specified by the Bank of Thailand.

(2.5) The duty to provide a manual for the investors and borrowers with the details specified in the consultation paper, for instance, credit rating information.

(c) For anyone who wish to borrow money from the platform, there is information which need to be considered such as;

(3.1) The information of the investors : the investor suitability assessment.

3. Conclusion

The issuance of the consultation paper can reflect the significant role of P2P lending industry toward Thai economy in the upcoming years. The proper regulations can balance the interest of investors, P2P lending operators and borrowers. Also, as an aforementioned statement, with appropriate regulations, P2P lending platform can be used in many ways to enhance the capacity of Thai SMEs and economic stability.

[i] Vorapatchaiyanont R. (2013), ‘Design of Online Peer-to-Peer Investment Platform Offering Incentive-Compatible Revenue-Sharing-Innovation’, https://economics.stanford.edu/sites/default/files/publications/joyvorapatchaiyanonthonorsthesis_may2013.pdf

[ii] Can Nano Finance unleash the grassroots from loan shark problems?, SCB Economic Intelligence Center, https://www.scbeic.com/en/detail/product/1255(last visited Feb.20, 2016).

[iii] The Role of SMEs toward Thai Economy and compare to other ASEAN countries’ potential, Exim Bank http://www.exim.go.th/doc/newsCenter/38795.pdf (last visited Feb.15, 2016).

[iv] Id.

[v] Loan rates of commercial banks, Bank of Thailand, https://www.bot.or.th/english/statistics/_layouts/application/interest_rate/in_rate.aspx (last visited Feb.15, 2016)

[vi] The Consultation Paper “Regulatory Framework for P2P Lending Industryâ€, the Bank of Thailand, https://www.bot.or.th/sites/Survey/FinancialInstitutions/Lists/P2PLending/NewForm.aspx?Source=https://www.bot.or.th/sites/Survey/Pages/ThankYou.aspx