![]() Swedish p2p equity platform Fundedbyme expands the product portfolio offered to p2p lending today. Typically loans are between 25 and 25,000 EUR. They pay yearly interest, a percentage of the profit and a possible exit bonus. Anyone can lend money to a p2p lending campaign on Fundedbyme. The minimum bid size is 50 EUR per loan. Daniel Dabocy, CEO of Fundedbyme on the reasoning of entering p2p lending: ‘The idea behind our business is to link investors with entrepreneurs in the most efficient way. That is why we talk with both parties very much. When we started to get regular feedback that they would be interested in something between equity-based and reward-based crowdfunding we thought about p2p business lending. And it turned out this is what they need. Now we are launching the product and I am pretty sure results will confirm that we took the right decision.’ (Source).

Swedish p2p equity platform Fundedbyme expands the product portfolio offered to p2p lending today. Typically loans are between 25 and 25,000 EUR. They pay yearly interest, a percentage of the profit and a possible exit bonus. Anyone can lend money to a p2p lending campaign on Fundedbyme. The minimum bid size is 50 EUR per loan. Daniel Dabocy, CEO of Fundedbyme on the reasoning of entering p2p lending: ‘The idea behind our business is to link investors with entrepreneurs in the most efficient way. That is why we talk with both parties very much. When we started to get regular feedback that they would be interested in something between equity-based and reward-based crowdfunding we thought about p2p business lending. And it turned out this is what they need. Now we are launching the product and I am pretty sure results will confirm that we took the right decision.’ (Source).

Fundedbyme says they have (for their equity offer) signed up 47,000 investors, so they are confident they will fund the new loan offers.

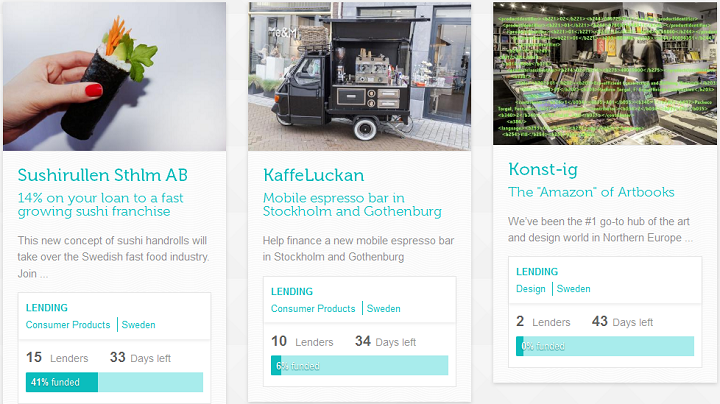

I just checked. Right now there are 4 loan-based offers open for funding on the site.

Every company needs to have a turnover of at least 15,000 EUR in early turnover, and have been registered for at least 1.5 years. In addition to this, the information from credit bureaus UC and Bisnode both have to give the company a favourable risk rating. Loans over 40,000 EUR have a personal guarantee. To invest, investors first need to upload an ID for check, approval can take up to 2 business days. Apparently it is possible to then deposit funds via credit card (I did not try).