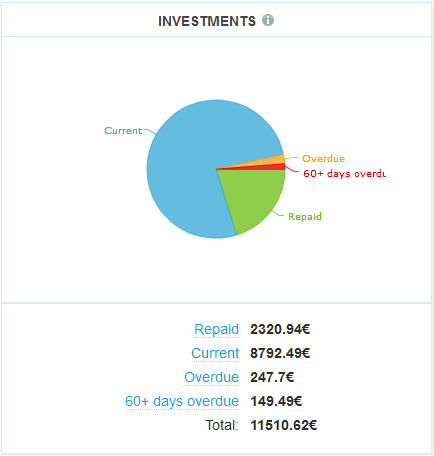

Three months have passed since I last wrote about the status of my p2p lending investment at Isepankur. I have deposited 8,000 Euro (approx. 10,500 US$) since starting in the end of 2012. I hold over 500 loan parts – the diversification achieved is very good. Together the loans add up to 9,190 Euro outstanding principal. Loans in the value of 248 Euro are overdue, meaning they (partly) missed one or two repayments. 149 Euro are in loans that are more than 60 days late. I already received 2,320 Euro in repaid principal back (which I reinvested).

Chart 1: Screenshot of loan status

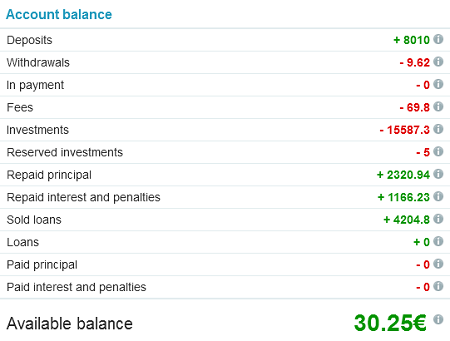

Most of the money in my account is working to earn interest. Only 30 Euro are currently held in cash. 5 Euro are tied in a bid on a current loan listing and will originate in the next few days.

Chart 2: Screenshot of account balance

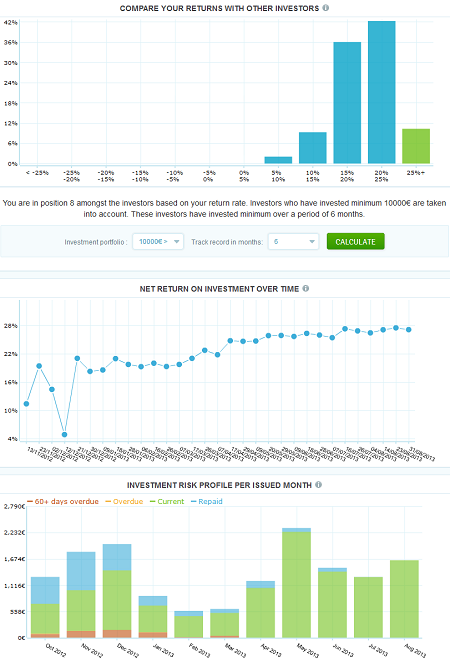

Return of Invest

Currently Isepankur shows me a 26.7% annual ROI (see chart 3 ). In my own calculations, using XIRR in Excel, I currently get a 23.5% ROI.

Chart 3: Statistics on ROI and funded volume

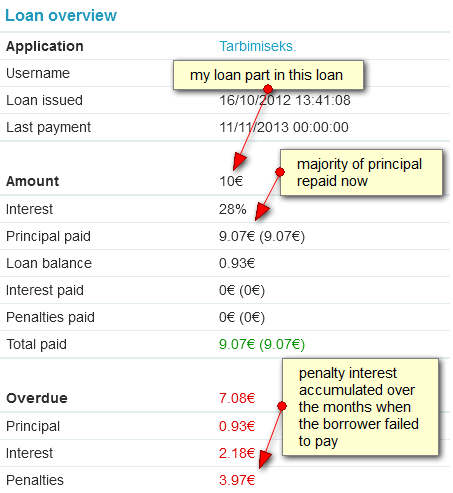

Recovery of bad debt

The level of bad debt in my portfolio is staying low. One reason is that I often sell overdue loans on the resale market before they become 60 days late. The other reason is that there are first results in bad debt recovery for my loans. I had 2 bad debt loans that were paid in full and two that made partial repayments. One example is show in chart 4. This loan was passed to the bailiff in the beginning of July for collection. As you can see so far most of the principal was recovered. As collection results look promising, I might decide to keep overdue loans in future rather than sell them off on the secondary market.

Chart 4: Example of a 60+days overdue loan in my portfolio

My current strategy

I continue to invest in loans with top credit score (A1000) with low or medium DTI. I usually lend in 40 Euro loan parts. I only very cautiously investing in the Finnish loans that are now in the market. My thinking is that it is better to slowly gain experience on the performance of the Finnish loans as there is no past track record. For the Estonian loans Isepankur has several years of statistics that can be reviewed. In fact recently Isepankur made the data of all originated loans since inception available for download and is planning to offer an API in the future. I am looking forward to Isepankur adding borrowers from more countries.

P.S.: isepankur kokemuksia is good