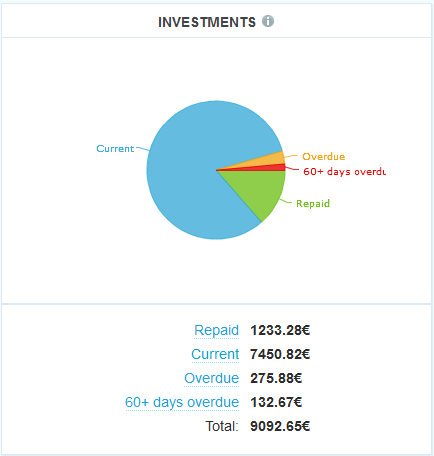

When p2p lending service Isepankur opened up to investors from all EU countries five month ago, I started lending there. In this post I continue the series of posts reviewing the development of my loan portfolio. I have deposited 7,500 Euro (approx. 9,700 US$) since starting. My investment is spread out over more than 400 loan parts. Together the loans add up to 7,859 Euro outstanding principal. Loans in the value of 276 Euro are late, meaning they (partly) missed one or two repayments. 133 Euro are in loans that are more than 60 days late. I already received 1,233 Euro in repaid principal back.

When p2p lending service Isepankur opened up to investors from all EU countries five month ago, I started lending there. In this post I continue the series of posts reviewing the development of my loan portfolio. I have deposited 7,500 Euro (approx. 9,700 US$) since starting. My investment is spread out over more than 400 loan parts. Together the loans add up to 7,859 Euro outstanding principal. Loans in the value of 276 Euro are late, meaning they (partly) missed one or two repayments. 133 Euro are in loans that are more than 60 days late. I already received 1,233 Euro in repaid principal back.

Chart 1: Screenshot of loan status

Most of the money in my account is working to earn interest. Only 98 Euro are currently held in cash. 245 Euro are tied in bids on current loan listings and will originate in the next few days.

Chart 2: Screenshot of account balance

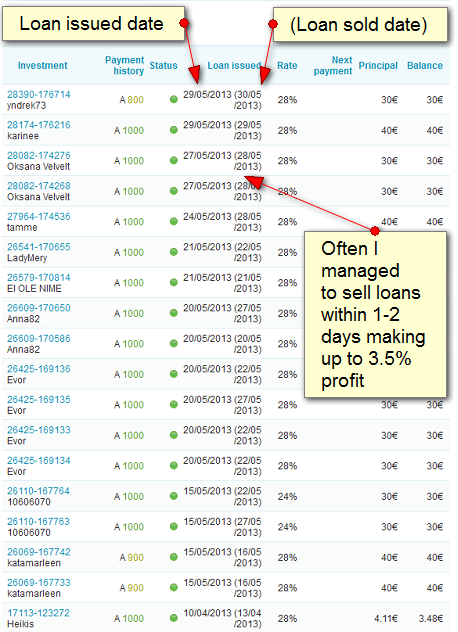

How I used the secondary market

Looking at my account balance (see chart 2) you will notice the relative large amount (2,032 Euro) of sold loans. This is due to 2 developments.

When the Isepankur secondary market launched in the end of March, I listed neary all my overdue loans for sale. Not only did I succeed to sell them within days, I also managed to sell them at 3 to 5% premium prices meaning I sold them at 1.5 to 3.5% profit (that is after 1.5% resale fee).

Secondly the resale market has been very active. I used that as I adapted my strategy and I am now investing in 2-3 parts of interesting new loans rather than just one as I would have before the introduction of the resale market. Immediately after the new loan is issued I list the surplus loan parts for sale at a 4 to 5% premium on the market. There are currently over 1,200 loan parts listed for sale on the resale market. Even disregarding the late loans, there is still a mass of over 1,000 parts for sale. This might lead to the expectation that it is hard to sell parts at premium.

Quite to the contrary I often manage to sell loan parts within 1-2 days. Even allowing for 1-2 days bidding phase and another 2-3 where the money sits idle waiting to bid, this means that I make around 3% profit in about 6 days. Extrapolating that results in a staggering annual yield.

Chart 3: Loans I recently sold

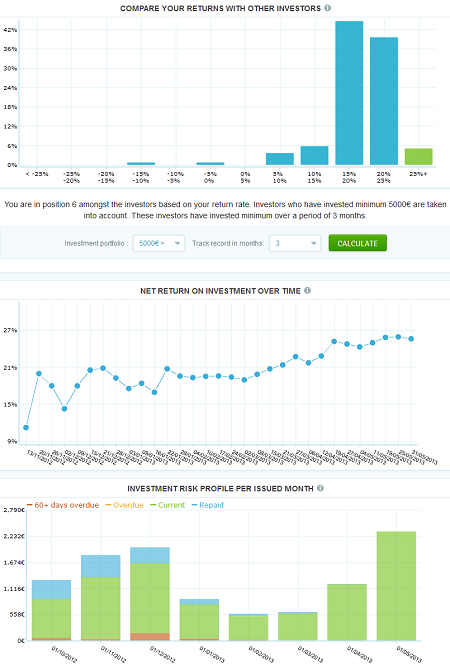

Return of Invest

Currently Isepankur shows me a 25.4% annual ROI. As chart 4 shows the ROI figure rose considerably over the past weeks. In my own calculations, using XIRR in Excel, I currently get a 16.3% ROI.

Chart 4: Statistics on ROI and funded volume

My current strategy

I primarily invest in loans with the top credit score (A1000). I often invest in two or three parts of 40 Euro each and then list all but one for sale. Even if they do not sell, my risk exposure to one loan stays limited and I continue to have a very diversified portfolio.

Isepankur originated a record loan amount in May

In May Isepankur originated a new record amount of loans. Over 400,000 Euro in one month. This figure needs to be seen in perspective to the borrower market Isepankur operates in. Estonia has a population of only 1.3 million. For comparision the UK has a population of 63 million – 48 times bigger. So if you compare Isepankur with a UK p2p lending sites, it would be like that site originating 19 million Euro loans in one month (which is rougly the volume Zopa originates per month).

In May Isepankur originated a new record amount of loans. Over 400,000 Euro in one month. This figure needs to be seen in perspective to the borrower market Isepankur operates in. Estonia has a population of only 1.3 million. For comparision the UK has a population of 63 million – 48 times bigger. So if you compare Isepankur with a UK p2p lending sites, it would be like that site originating 19 million Euro loans in one month (which is rougly the volume Zopa originates per month).

Isepankur is offering jobs in preparation to the the planned expansion into serving borrowers in Finland, the Netherlands and Spain.

Hello,

I’m following your portfolio and it’s very interesting what you are doing!

I’ have a question for you, in Italy, where I live, I use smartika and every year they give me a document with the certification about money gained because I have to pay taxes on it.

IsePankur works the same? I’d want to try but i don’t want tax problem in Italy. I see that your portfolio is younger than 1 year….

Thank you for your answer

Giulio

There is an income report that shows you the earned interest (plus earned penalties) for the previous year. I have that for 2012.

Hi, how do you manage to get multiple bids on one loan? When doing manually, I always miss new opportunities as they are usually closed within minutes. And you can have only one robot per investment category … Is there some VIP access / special rules / some other trick or you just have your own robot scraping the content of website?

To do multiple loans on the same loan you have to do it manually.

Hello, good work. I’ve been doing some research on Isepankur and your articles have really helped me out. I am glad you did this follow-up article. I think I am now ready to join. I was wondering if you could answer the following questions:

1) Do you get paid monthly for the duration of the loan period (provided payments are on time)? it is not an interest only loan right where you get repaid the capital at the end?

2) How would you explain the divergence between your ROI and the one on the platform?

Thank you very much and good luck!

re 1) yes, each month the borrower pays interest and part of the principal

re 2) different method of calculation

https://forum.isepankur.ee/f_postsm18332_How-do-You-measure-Your-portfolio-in-isePankur.aspx#post18332