More and more p2p lending services are launching, each catering to different markets and different target audiences. Some derive more features from "ancestors" Prosper or Zopa, some less.

All follow the aim to allow lenders to directly lend money to borrowers without a bank acting as intermediary. This aim is sometimes not pursued strictly to the point. Smava actually partnered with a bank to comply with regulation, Zopa US partnered with credit unions, but nevertheless it serves as comprehensive definition.

Dividing p2p lending services in categories could follow several possible factors:

- price building mechanism (auction/non-auction; interest set by platform/by borrower/by lender)

- purpose of loan (private/business/both)

- social lending vs. lending for profit

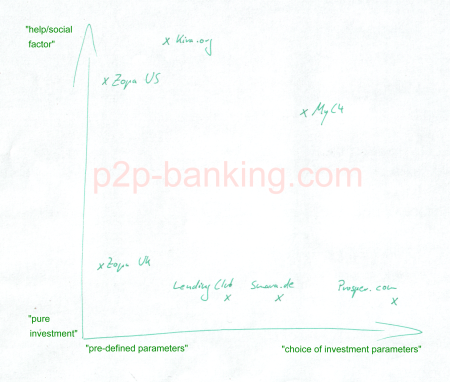

I think the last factor is most useful for the definition of categories. It affects all parts of the service from marketing to operations. The differentiation is in the objective the majority of the lenders had when selecting the platform. Were they attracted by the motivation to help an individual through a loan or by the motivation to earn interest?

Obviously the "help factor" is a main motivation at Kiva, MyC4 or Microplace, where loans to borrowers in developing countries are funded. But on closer inspection Zopa US fits in this category too. Interest rates for lenders are capped and lenders can "help" a selected borrower by forgoing parts of the interest.

Another good parameter to differentiate the services on, is the amount of choice the lender is given. Zopa UK started with a service where the lender could not select the individual borrower but invested in 'markets'. At Lendingclub lenders can choose which borrower to lend to, but the interest rate is set by the platform. Smava offers more freedom of choice, but the pool used for risk spreading is mandatory. Prosper offers the largest set of choices and information about the borrowers (credit) history.

What do you think is a food way to classify peer to peer lending services? Post your suggestions in the Wiseclerk forum.