![]() Bondora* has announced that the p2p lending marketplace platform is now accessible in 24 European languages. Bondora says it already has more than 42,000 investors from 85+ countries worldwide, that have invested more than 150 million EUR in the consumer loans listed on the Bondora marketplace. Bondora gives investors the choice of different investment products: Bondora Go&Grow, Portfolio Manager, Portfolio Pro and API Investment.

Bondora* has announced that the p2p lending marketplace platform is now accessible in 24 European languages. Bondora says it already has more than 42,000 investors from 85+ countries worldwide, that have invested more than 150 million EUR in the consumer loans listed on the Bondora marketplace. Bondora gives investors the choice of different investment products: Bondora Go&Grow, Portfolio Manager, Portfolio Pro and API Investment.

The popular Go&Grow product carries a yield of 6.75% and offers high liquidity.

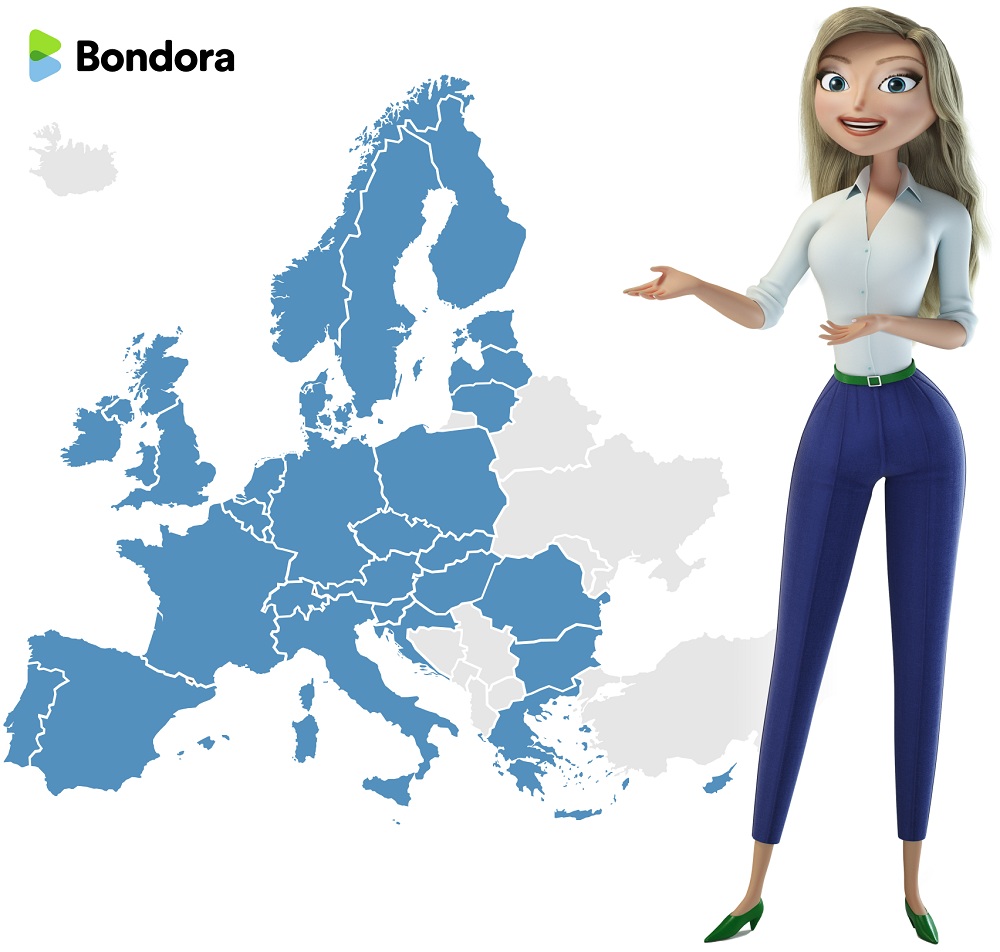

Now the Bondora website can be used in 24 languages ranging from Bulgarian to Swedish. Bondora says they have taken this step, because they want to open their doors to Europe and make the platform accessible for all. Investors feel much more comfortable using a site which is in their native language.

Map of the local languages Bondora now supports

Want to start investing at Bondora* now?

Use this link to sign up at Bondora*, and the normal signup bonus will be doubled for you, meaning, if you invest, you get 10 EUR bonus that you can use for investing. This is a limited time special promotion (after which the signup bonus will be 5 EUR again).