Part I: Platform & lender view

Occasionaly, when I talk to analysts or journalists, their perception is that p2p lending is very similar to bank loans. They argue:

- The platform does check, if the borrower is eligible to receive a loan by validating credit history, income and other documents just like a bank would do (note: this argument applies more to Zopa and Smava, less to Prosper)

- The listings descriptions and photos just give the lender the illusion that they know where their money is going and for what purpose. In reality nobody checks the information in the listings and the listings could be all false.

- The p2p lending platform is just taking the role of the bank. The platform earns fees on each loans which is comparable to the spread the banks live on.

My opinion is that p2p lending is very different from banks giving loans.

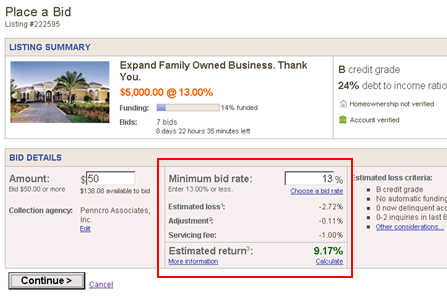

One main difference is that the platform does not have the loans in their own books. The risk is carried by the lender. The platform must aim to provide as much information as possible to allow the lender to gauge the risk and it must prevent the lenders from fraud. It is then the decision of the lender, if – based on the information – he wants to bid or refrains.

For the lender the ability to decide who gets the money is a major motivation compared to depositing the money in a banking product. The p2p lending services are aware that the listings are a central point to their marketing. Zopa, which currently does not have individual borrower listings, will introduce 'Zopa listings' in the future.

Regarding argument 2: It is true that listings are not checked on any of the platforms and a borrower could use the loan for a totally different purpose then stated in the listing. My opinion is that this is not a problem, as long as lenders are aware of this and as long as the protection from fraud (identity theft; no intention of borrower to repay in the first place) is high. I don't care if 2, 3 or even 20% of the borrowers lie in their listings. I believe that the majority is telling the truth and what I really care about is that my money is repaid. The borrower said he wanted to use the money for the college education of his daughter and actually used the money to buy a new car? I personally would not care as long as he repays the loan.

P2P lending services achieve a level of constant interaction with the lenders few banking products reach. In the Prosper forums many lenders express that they spend a lot of time on Prosper browsing and selecting listings and that they find this process somewhat addictive.

Conversely that means that p2p lending is not for lenders that to large amounts of money without spending time.

Conclusion: P2P lending IS different from the way banks loan money. It offers a different marketing angle, the risk is taken by the individual lender rather then the bank, and gives the lender has more control over what his money is used for.