Can you think of a better way to turn hard labor into a little bit of joy and play for Kids? See PlayPumps for a really good idea.

Can you think of a better way to turn hard labor into a little bit of joy and play for Kids? See PlayPumps for a really good idea.

Prosper is hiring a Vice President, Institutional Lender Development. Job description:

As Vice President of Institutional Lender Development you will be responsible for ensuring Prosper has an adequate supply of liquidity. You will need to create an institutional sales process that identifies institutional prospects and sells them on the benefits of lending on Prosper. The position will also be responsible for developing strategies and structures that match the risk and return preferences of prospective lenders. This position will have an attractive incentive compensation plan dependent on meeting goals for institutional lender growth and marketplace liquidity.

This is an interesting development. First, if successful, it will scale up volume. Secondly, at least on the lender side, this step dilutes the peer to peer aspect of the marketplace.

Dutch p2p lending service Boober.nl is quarreling with the regulating authority AFM. The AFM argues Boober needs a licence because it allows lenders in peer to peer lending to engage in commercial activities.

Boober CEO Guus Drijver denies that. He says that lenders can lend out only a maximum amount of 39000 Euro and even with an assumed interest rate of 10%, 3900 Euro profit per year could hardly be seen as commercial activity.

(Source: sprout.nl)

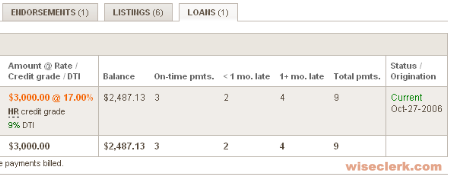

Prosper.com now makes the link between loans and listings available. With this new feature now everyone can see the status of the loan payments of every borrower. On the borrower profile page there is now a "Loans" tab:

Previously only lenders invested in a loan could directly see, which status it had. All others had to use 3rd party tools like Wiseclerk.com. Those had to program their own matching algorithms since no key matching loans to listings was published by Prosper.

Prosper has always been the p2p lending service that made most data available about its market.

I will have to look into which parts of Wiseclerk.com I need to rebuild to make use of the new information linking listings to loans.

Further improvements that Prosper announced include reporting to Transunion and enabling borrowers to repay directly using money in their Prosper account.

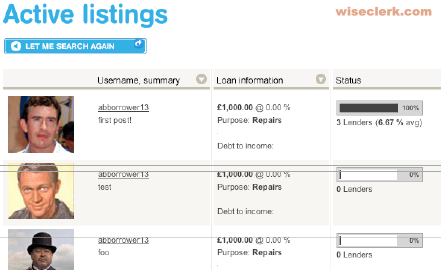

Tuesday I wrote about Zopa's plans for Zopa listings. Now a preview of how the new Zopa listings will look is available. With this feature Zopa will take the step from anonymous borrowers to a more personal look with borrower listings and profiles. To create a listing borrowers will have a credit grade of at least C.

I looked at the preview today and found the resemblance to Prosper.com layout striking in many points. The listing overview will look like this:

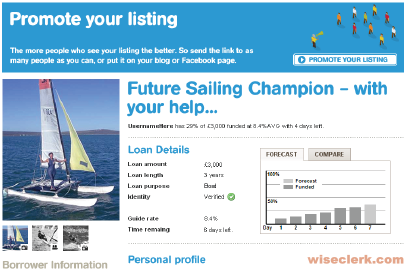

The loan listing itself has photos, a loan details section, a personal profile section and borrower information. Furthermore it will have a Questions and Answers Section allowing the lender to ask questions. Looking at the following example the forecast graph in the upper right looks exactly like the same feature Prosper offers:

The 8 page preview description gives more example screens of Zopa listings, which Zopa says it will introduce within the next months.

Lender feedback (which is limited so far) has been mixed.

With this changes, should the Prosper & Zopa merger that Jeff & Heather wish (it is really only wishful thinking!) ever happen, then at least the layout question seems decided now.

Social lending service Kiva has refined its risk assessment for participating MRIs (microfinance institutions). The changes and the mechanism are described here. Risks for Kiva lenders include Entrepreneur Risk, Fieldpartner Risk and County Risk.

So far the default rate for Kiva has been 0.17% on a loan volume of $9.965.000 (4.4% of loans are one month late). When compared to Prosper.com default rates, that is an extremly good result. So far the MRI on Kiva with the worst performance is REDC Bulgaria, followed by an MRI that organizes loans to people in Uganda, Kenya and Tanzania.

Another interesting figure: The average time a listing is online at Kiva.org until it is fully funded is 1.24 days.

So far all my Kiva loans are repaying on schedule.