I started investing at the UK p2p lending marketplace Saving Stream in December 2014. The last Saving Stream review I wrote was 9 months ago, therefore time is right to post an update on how my portfolio is developing.

For those p2p lending newbies that have not heard of Saving Stream so far here are the basics again:

- Bridge loans, secured by commercial properties (first or second charges)

- 12% interest (interest rate is the same on all loans on the platform)

- 0% fees for investors (on primary and secondary market)

- All loans prefunded; investors earn interest from the day they invest money into a loan

- A provision fund shall provide a buffer against default losses

- Open to international investors

To deposit money I used Transferwise and Currencyfair saving me bank fees and allowing me to know the currency exchange rate in advance.

I made 5 deposits over time totalling 5,441 GBP (7,403 EUR).

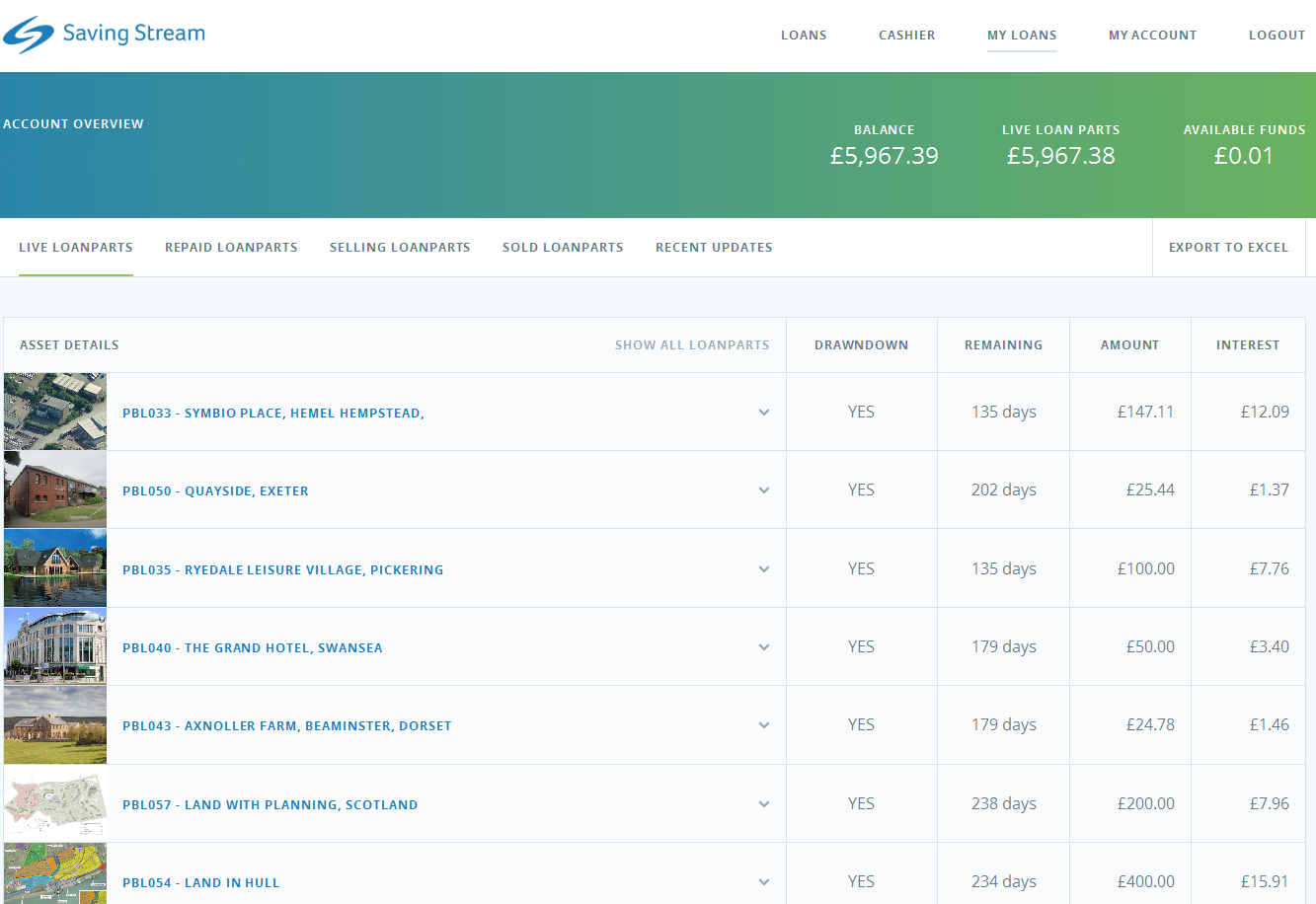

Screenshot: Top of the list of my Savingstream loan portfolio

My portfolio grew nicely and yields a very got ROI

As you can see in the image, my original 5,441 GBP grew to 5,967 GBP current portfolio value. I reinvested all repayments and interest earned. It sure is nice to earn 60 GBP interest per month (1% of live loan parts amount). My ROI is actually a bit over 12% so far as I profited from several cashback offers. I did not experience any defaults on my loans so far.

The new website

Late in 2015 Saving Stream overhauled the website. Major improvement is that this fixes the situation which frequently occured on the old website, where loan parts sold/bought on the secondary market might get stuck when a loan amount left on offer accidently ran into a negative value and needed manual operator intervention to clear. The new website also introduced the two step verification security option. I enabled this security feature for my account.

My strategy

I reinvest all interest and repaid principal into new loans. I try never to hold any loans until maturity. Instead I sell loan parts that approach 90 days remaining loan term on the secondary market, when a new loan becomes available. The Saving Stream secondary market is very, very, very liquid. My last sale took less than 2 seconds after I listed the loan part. Some of the investors use bots to automatically buy up availiable loan parts. This January Saving Stream introduced Captchas presumably to prevent/control the usage of bots.

Prefunding

Prefunding allows investors to pledge amounts they want to invest into future loans. There is one general setting applied to all future loans and I can also select individual amounts for each pipeline loan. Using the prefunding setting is pretty much mandatory nowadays for investors building a portfolio at Saving Stream. Not an unusual situation for a marketplace where demand seems to severly outpace loan supply (see also ‘Queue up for p2p lending‘). Saving Stream experimented quite a bit with the prefunding algorithm last year. The current system is that for loans up to 500K 1M each successful investor gets allocated the same amount (unless he wanted less than this possible amount), whereas for larger loans the old system allocating the same percentage of desired prefunding amount is continued to be used. The current system suits me just fine.

My conclusions so far

Saving Stream offers me an attractive yield for the risk involved. I like the platform, which is pretty straightforward to use. I can let it run pretty much on autopilot, unlike other platforms it does not require much monitoring. I don’t encounter any accounting pecularities that puzzle me and require me to contact support (again unlike other marketplaces).

I consider to top-up my invested amount further.

Could you touch on how income tax affects this investment please?

I can’t as this is dependent on the country of residence of the investor. Please ask a qualified tax advisor. Saving Stream is not withholding any taxes. The investor has to declare them himself according to the rules that apply for him.

Hello,

I am new to the p2p platform. Could you describe more simply the key benefits of this strategy, please?

Later when a new loan comes online, I sell some of the older loan parts (they usually sold within minutes) on the secondary market to reduce my position in this older loan and invest this amount into the new available loan. Many investors seem to be doing the same, as it is a typical pattern for older loan parts to come on sale just as a new loan is listed.

I reinvest all interest and repaid principal into new loans. I try never to hold any loans until maturity. Instead I sell loan parts that approach 90 days remaining loan term on the secondary market, when a new loan becomes available.

Thank you very much.

Hi Jan,

all loans on Saving Stream only pay interest during the loan term, while prinicpal is paid back at the end of the loan term. That means the time when the loan could go in default, because the borrower is unable to repay the principal is at the end of the loan term.

By selling the loans early I avoid the risk of being stuck with a loan part that is overdue on making the principal repayment (you can sometimes see those parts on the market as they are listed with a negative loan duration).

Was this more understandable?

Hi,

Thank you for your explanation and description of your strategy on that platform.

Jan

Thank you for that tip!

I can see those now that I look. Do you know what happens in those situations, do the properties get repossessed and the principals recovered?

Hi Robin,

there was at least one loan on Saving Stream that defaulted where the security was sold off and covered the outstanding principal fully. But this investors need to be aware that the 12% interest comes with risks, especially in a downturn of economy property values will likely sink.